Financial Transparency:

Pricing Structures and Philosophy

There are all kinds of different pricing structures out there. In the case of high-end brands like BMW or Leica, the brands often have a MAP, or minimum advertised pricing. This acts to prevent retailers from eroding a brand's value by advertising products below what a brand says they are worth. When it works out it sets up a positive feedback loop which serves to reinforce the brand's value. Which is good for the brand, if that's their strategy. Typically, astronomy gear can be thought of as high-end luxury goods. Not quite as shiny as a diamond-encrusted Brietling, but a full astrophotography setup can ironically be much more expensive!

Other times, manufacturers will introduce Reference Pricing to keep a level playing field for their dealers. In this scenario, the dealers are (forced, in some cases) to sell goods at or above a certain reference price - and they are not allowed to undercut it without approval. As a result, the retailers make a higher profit per sale, and are driven to remain competitive by bringing their customers value in other ways. Done correctly this helps foster a healthy market, more dealers are able to participate in said market, and the manufacturer has more customers to sell more products to.

One non-astro example of both MAP and Reference Pricing is in the stills/hybrid camera market. As someone who has made a few purchases of Sony E-mount products in the last few years, I of course inquired after the possibility of some type of discount. The answer I was met with was a sincerely delivered "Sorry, no." with the explanation that Sony prohibits the practice in order to keep a level playing field. The various camera outlets are forced to differentiate and compete based on the other value they can bring to their customers.

We carry products from manufacturers that subscribe to both of these policies. That is why the pricing on our store is within a few dollars of what the products' MSRP and/or MAP is in their reference currencies (large jumps in exchange rates notwithstanding). We don't want to get our wrist (or worse) slapped, but as long as our suppliers permit the practice we are open to price matching our competitors.

My strategy has always been to provide a fair price and to try and bring as much collateral value as possible to the table, and that will continue to be one of the core values of my business. Anyone who's received an email reply from me at 3AM helping to troubleshoot a snag so that they can get back to focusing on imaging knows that I take those core values seriously. I would love for it to be you that I'm helping to get up and running, and I hope you'll choose Fervent Astronomy so that I can do so!

How Fervent Astronomy Generates Income, A.K.A.: So You Wanna Get Into Retail?

I want to preface this by saying that while I am obviously a willing participant in commerce I'm also not a huge fan of how the world has settled on making itself go 'round. But I can't do much to change that, and if you can't change the game (and if food/clothing/shelter are on the line) then you'd better play. That doesn't mean that I can't try and play according to my own values though!

I just love astronomy.. that's just kind of it, I just love it. I have a degree in a completely unrelated field, and have done lucrative work in that field. And it was hard to get up in the morning, and I needed a change. And somehow one day I found myself quitting my job, and ending up in the astro industry completely by fluke. Even though I loved astronomy and astrophotography I wasn't looking for the opportunity, but it fell out of the sky and I'm doing my best to run with it.

I'm not looking to make much money with this business, to be frank (shhhhh, don't tell my wife!) I'm just looking to make enough to pay some bills and feed my family and give my kid a decent childhood. I know that's trite and cliche and kinda boring, but there you go. Fervent Astronomy is a family business, with no employees, and that's all that I want it to be. There are enough hours in the day (and night) for me to handle things myself at the level that I need to be sustainable, and that's all I want. Because I want to wake up every morning and do something that makes me happy.

Maybe I just like going against the grain, and this is one of the great taboos in business, but I'm going to walk you through exactly what we make whenever you place an order with us. This isn't going to be an earth-shattering revelation by any means, but here it goes:

We buy stuff from our manufacturers and then sell it to you for more than we paid. Shocking, right? In between our ordering a product from our suppliers and it arriving on your doorstep there are a ton of third parties who eat a piece of the pie. Here's how it all shakes down:

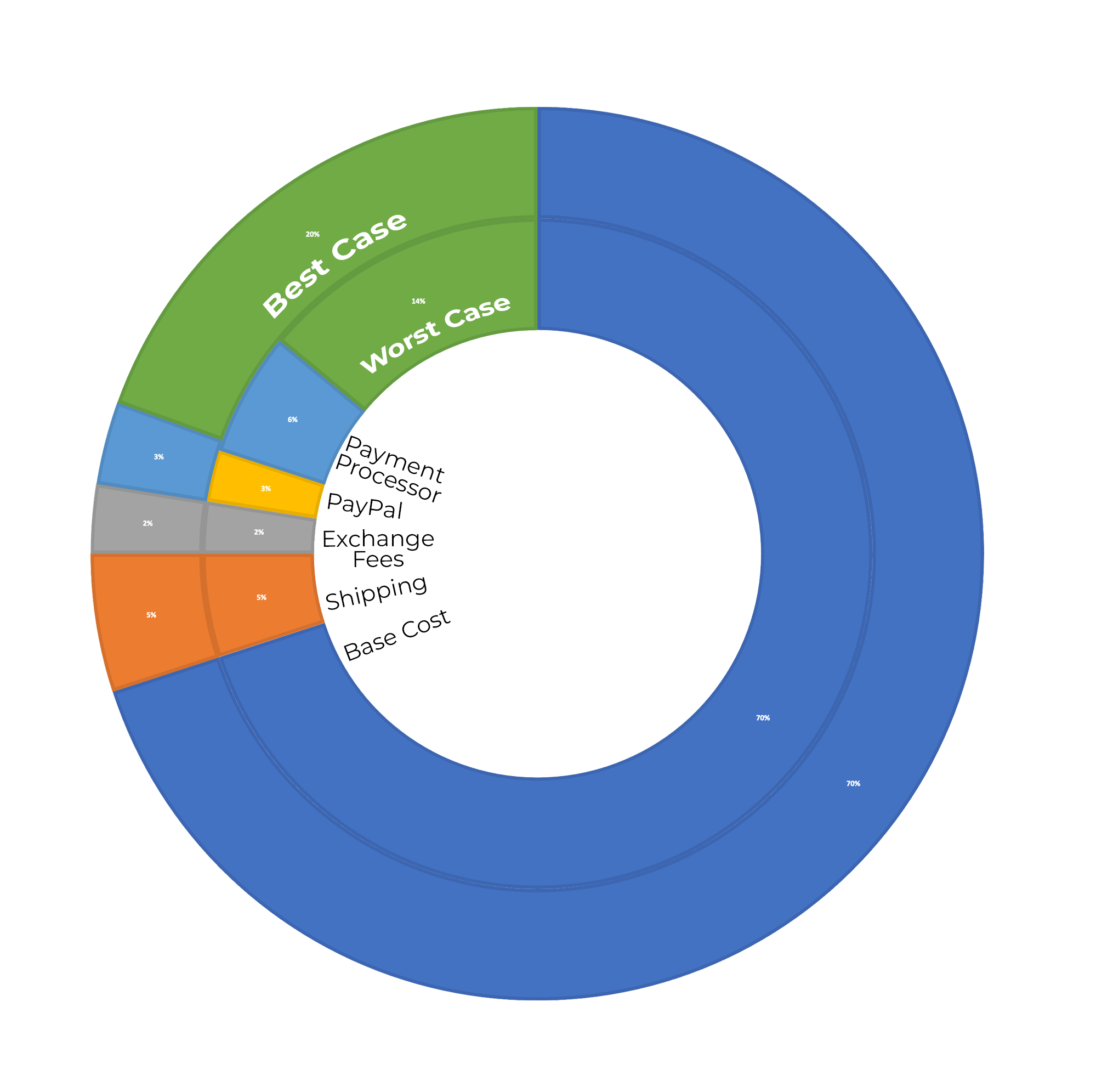

Nothing that we sell has a potential profit margin greater than 30%, which is the difference between the dealer price we pay and the MSRP. That means that, at absolute minimum, we paid our suppliers 70% of whatever your purchase from us cost you (before taxes and shipping). Put another way: when you buy $1000 of product from us at least $700 of that goes toward replacing the capital we spent to purchase the product from the manufacturer in the first place.

Next is shipping. Few of our manufacturers provide free shipping. There are some cases where if we order a minimum amount of product the shipping is covered, but the minimums are not low (at least for a small entity) and not universal. Shipping charges range from USD$50 (CAD$64) to 600 Euros (CAD$864 - oof). To use a recent shipment as an example, the shipping charges we paid to import the product were equivalent to about 5% of the profit margin on the entire order. Before we even receive it, the hypothetical best-case profit margin on our optimally profitable product has shrunk from 30% to 25%.

Now we have to reckon with exchange rates. All of our suppliers bill us either in USD or EURO, and if you know anything about the Canadian Dollar it should be that it's not worth that much. That's just an inherent property of living in Canada, but where it actually gets expensive is where banks get involved. Because regardless of how we pay the invoice (wire transfer, credit card, PayPal), the relevant financial institution is going to be charging about a 3% cut for exchanging the currency from CAD to USD or EURO. This is something Stateside and European dealers don't have to reckon with if they're purchasing in their local currencies. This is one reason why we can't price match international dealers. There are extra fees here as well. Wire transfers incur set fees (usually under $50 per transaction), and paying via PayPal incurs an additional 3% on top of everything else as most suppliers who accept PayPal stipulate that the purchaser must cover the associated PayPal fees. This translates to a reduction in profit margin of roughly 2.5% in both cases. Our 25% just dropped to 22.5% in the best case scenario, 20% in the worst case.

Now our shipment is about to arrive in Canada. The associated shipping carrier is more than happy to broker the import for us, for an assortment of brokerage fees ranging from $10.50 up to $40, and maybe an extra $30-$50 or so if they have to enter extra line items. Lookin' at you, DHL! Fedex is usually the best in this regard, DHL almost as good but gets wild sometimes, and UPS is by far the worst with regards to brokerage fees (Boooooourns!). And then, that one thing you can never escape: taxes! The Canadian Customs and Border Services Agency collects 5% General Sales Tax on any import for any reason, even gifts, above $20. This GST alone translates to a further erosion of 3.5% of our profit margin in our hypothetical best case scenario. We'll ignore the brokerage fees. Most astronomy equipment is not dutiable, so we can more or less ignore duty (usually 5-6%) for the bulk of imports. Now we're at 19%-16.5% remaining profit margin for the current calendar year. This GST is returned as a tax credit the following year in certain scenarios (if the product remains in stock at the end of the year or if the product was exported from Canada. Domestic sales are touched on below), but it can tie up many thousands of dollars of operating income for 12-14 months in some cases (depending on when it was invoiced and when tax returns are filed).

Finally! The product has arrived. It is sitting on a stock shelf, waiting for a forever home. And there you are, ready to give it that forever home! You make your purchase, and the gears start turning. If you're located in Canada you are charged some combination of GST/HST/PST depending on where you're located. The gross value of these taxes are rendered to the Canada Revenue Agency for the government to spend on all our free health care or whatever. Since we previously paid GST on a portion of the import we get that portion "back", which strikes out that line item for us. If you're purchasing from Canada, the amount of tax you see when you check out is the exact amount the government gets. Some of it still comes out of our pocket, however, unless you're paying cash (touched on below). As the customer you typically also end up paying shipping and parcel insurance. We use this to pay the shipping carrier, often immediately, but at minimum within two weeks. Now, I love free shipping, who doesnt? And I would love to be able to offer it. Unfortunately, in many cases if we offered free shipping we would be in the red.

We aren't done quite yet: unless you are paying in cash (something that happens 0.001% of the time since we're an online business) as soon as you click that button and pay for your order, at minimum 3% of that money disappears and goes to our payment processor. 4% used to go to PayPal but we stopped using them because they suck. If you are taking advantage of the AfterPay service to split up your purchase into 4 interest-free payments, 6% of that amount goes immediately to AfterPay (but our customers at least get some benefit out of that bargain). This includes what you paid in shipping and any applicable taxes (as hinted at above), and our business must make up that difference out of the profit that shakes out at the end of everything.

Using our optimal product, approximately 3 months into the calendar year following the year you made your purchase, when our taxes are filed and we get our tax return and any GST credits, we've finally made a total of 19.5% profit from that original $1000 sale. And that's in the best-case scenario. In the worst-case scenario, we're now down to 14%. If the MSRP on the product was an even $1000, that's a net profit of $195 at the high end and $140 at the low end. The other $805 to $860 were spent by us just facilitating getting the product from the manufacturer to the consumer. And this is all assuming MSRP with no price matching. Other brands offer lower maximum margins, such as 25% or 20%. Those 20% ones aren't really doing much for us now that I think about it, lol.

So now what? Well, there's overhead and expenses. Luckily we don't operate a brick and mortar location and as such don't have to cover additional commercial rent and utilities. We pay for a bunch of services, such as web hosting, domain management, online point of sale, web development software (I do the actual website development myself), additional software and plugins, computer hardware and other IT hardware, advertising, demo equipment, insurance, travel expenses, packing supplies, etc. It's a big list. And all of those expenses need to be paid before any of that $195 to $140 ends up going towards our home mortgage, utilities, food, my camera gear habit (jk, I put that in to see how far my wife gets), etc.

And that's where your money goes, essentially! More than two thirds to the manufacturer. Half or more of what's left goes to third parties in some cases, in other cases only about a third of what's left goes to third parties. What's left is split between business expenses, and either expanding our stock selection or paying living expenses.

Woo! Exciting! So you wanna get into retail? JK! But seriously, if you can, find something that you love and try and make it happen. We're all only here for a limited time, why not try and be happy while we're at it?

OUR BRAND PARTNERS:

Fornax has been developing and producing astronomical equipment for 20 years now. Our main focus is manufacturing astronomical mounts, but our range includes other astronomical auxiliary products. In addition to private projects we have been involved in such prestigious projects as the HAT (Hungarian Automated Telescope) project, one of the most successful projects in exo-planet exploration, or the BlackGem project. Our customers include Harvard and Princeton universities. Our mounts are used by many famous astrophotographers, and their award winning pictures taken with the help of our products stand as testament to the quality.

QHYCCD designs and manufactures world-leading astronomical cameras, ranging from entry-level to professional, CMOS and CCD, front-illuminated and back-illuminated, specially crafted for amateur and professional astronomers worldwide.

In a relatively short time, William Optics has established itself and its products as one of the world leaders in short-tube, highly-portable refractors, and has achieved quality recognition for many accessories such as the well celebrated WO Diagonals.

We plan to keep producing fine instruments both for the entry-level and the top-end segments. In the coming year, you will have many pleasant surprises: on top of a whole new range of larger Apochromatic telescopes, we will begin marketing new accessories and binoculars for all pockets.

Far from limiting ourselves to astronomy, in accordance to the founders’ passion for nature in all its aspects, we will increase our efforts to produce superior products for the bird-watching enthusiast and the casual observer alike.